Insurance companies frequently experience significant delays in reimbursing hospital costs. Faced with this situation, some hospitals are now refusing to cover policyholders who are unable to immediately pay for their care

Rosemène felt relieved when she signed up for health insurance in 2023. Finally, she thought she would be safe from financial catastrophe in the event of illness.

But last November, after an attack of abdominal pain, Rosemène went to a hospital in Pétion-Ville which appears on her insurance list. At reception, the verdict falls: the establishment does not directly take care of patients insured by its company.

“I had to pay for the consultation and the exams out of my own pocket,” says Rosemène.

This is not an isolated case.

In Haiti, many policyholders complain about the quality of services offered by insurance companies. Thinking they have health coverage, some discover at the critical moment that their insurance does not cover the expected costs.

According to several testimonies collected by AyiboPost, when a patient goes to the hospital with their health insurance, it often happens that they do not benefit from the planned reduction. Forced to pay the full costs, they must then take personal steps to obtain a reimbursement, an often long and tiring process, which can extend over several months.

In Haiti, many policyholders complain about the quality of services offered by insurance companies.

In reality, insurance companies often fall far behind schedule before paying hospitals that have agreed to receive policyholders. Because of these delays, some healthcare establishments are hesitant to welcome insured patients.

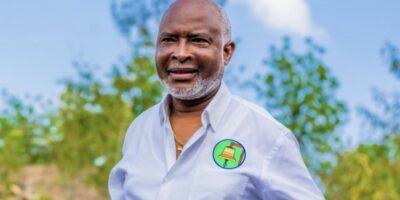

“This is not a refusal to support insurance beneficiaries, but companies do not always respect their commitments within a reasonable time,” explains Dr. Berthony François, CEO of Elohim Complexe Médical.

Some insurance companies “accumulate debts for almost a year, which complicates the daily management of care in a context where hospitals must face constant expenses,” continues Dr. François.

The same observation applies to Dr. James Almazor, director of Sage City Med Hospital, located in Delmas 19. The establishment, which previously collaborated with three insurance companies based in Port-au-Prince, had to scale down those partnerships to two due to delays and payment defaults.

The hospital no longer accepts policyholders from the Workplace Accident, Sickness and Maternity Insurance Office (OFATMA). A difficult decision taken four months ago, but necessary, according to Dr. Almazor.

“It’s not that I refuse to treat patients, but when the insurance does not reimburse the services, the entire functioning of the institution suffers,” he explains.

According to Dr. Almazor, OFATMA owes Sage City Med Hospital a fee for a surgery performed two years ago. “We operated on a patient covered by OFATMA, and to date, we have never been paid. All the steps taken to obtain this reimbursement have remained unanswered,” laments the doctor, who has been at the head of the hospital for eleven years.

It’s not that I refuse to treat patients, but when the insurance does not reimburse the services, the entire functioning of the institution suffers.

-Dr Almazor

Gladys Thomas, general director of Hôpital Espoir, indicates that the establishment has no longer accepted OFATMA policyholders since 2020 due to non-payment. “The company has accumulated debts to us for approximately nine years. Today they are close to hundreds of thousands of gourdes,” she explains.

The manager deplores the quality of the service offered by OFATMA. She affirms, however, that the hospital continues to collaborate with other private insurance companies present on the market, although they sometimes accumulate certain delays in their payments.

“If an insured cannot benefit from the service when he needs to obtain care and he has to pay for the entire service himself, then subscribing to an insurance policy almost no longer makes sense,” declares, frustrated, Jean-Marc, employee of a financial company for two years in Port-au-Prince.

Jean-Marc claims to have followed all the steps since his consultation in January: filling out the forms, attaching the invoices… However, to this day, he has still not been reimbursed.

“If I hadn’t had the means to pay the fees, I don’t know what I would have done,” he adds.

Rudy Sanon, insured with INASSA, had the same experience as Jean-Marc in May 2023. He went to the Canapé-Vert Hospital with his wife, who needed care, in an establishment covered by the insurance network.

“When I arrived, they didn’t accept insurance. They told me to pay the service fees as normal, then go and take steps with the insurance company to obtain reimbursement,” explains Sanon. Discouraged by the paperwork, he simply decided to pay the fees without filing an appeal.

A former policyholder of International Assurance S.A. (INASSA), who requested anonymity, describes an experience marked by dissatisfaction, particularly due to significant delays in reimbursements. Employed by a public institution in Haiti, she benefited from this insurance between 2016 and 2022. During this period, the challenges were recurring.

“Almost every time — at least five or six times — that I received care using my card, I had to pay in advance the entire cost,” she confides. “And when it came to obtaining the planned reimbursement, the delays were often very long, sometimes more than three months. »

The woman mentions an episode that occurred in May 2022. That day, she went to a laboratory affiliated with the insurance network, MedLab, located in Canapé-Vert. “I had to pay for the service in full. It was only in August 2023 that I was finally reimbursed,” she says, bitterly.

Since then, she has been very hesitant to renew her insurance policy. “When we advance the costs and wait months to be reimbursed, we lose confidence,” she concludes.

Just as this irregularity penalizes insured patients, it also impacts the healthcare professionals who provide care. “When insurance is slow to pay [the hospitals], it creates a deficit in my monthly income,” says Ricarven Ovil, a general practitioner at a private hospital in Tabarre.

Contacted by AyiboPost regarding the difficulties encountered by customers with their insurance policies, INASSA did not wish to comment. The company claims to be open and available to all customers in the event of complaints or grievances.

Just as this irregularity penalizes insured patients, it also impacts the healthcare professionals who provide care.

OFATMA, the main health insurer in Haiti, also contacted, did not respond to requests for comment from AyiboPost.

In Haiti, the insurance sector has evolved for several years in a vague regulatory framework, marked by an overlap of responsibilities between the Ministry of Commerce and Industry (MCI) and the Ministry of Economy and Finance (MEF).

According to the journal Development of Financial Knowledge & Skills published by the Bank of the Republic of Haiti (BRH) in November 2024, a decree of March 20, 1981 attempted to clarify which institution does what.

Officially, it is the MEF which is responsible for supervising the sector, while the MCI grants operating authorizations to public limited companies.

But in practice, neither ministry fully exercises its role, leaving insurance companies to operate without real control, according to the BRH review.

To compensate for the absence of an appropriate regulatory framework, the MEF established the Insurance Supervision and Control Unit (USCA) in 2012, the objective of which was to establish more structured control of the sector.

The lack of regulation in the healthcare system makes facilities and providers particularly vulnerable.

Read also: Sandra René paid her insurance every month. She died from lack of care.

Dr. Almazor had the bitter experience of this.

“I remember that between 2011 and 2013, when I was a doctor at the French Hospital, a patient presented for surgery. He was employed in a public institution and benefited from an insurance policy with Onyx Assurance at the time,” he explains.

The doctor agreed to take charge of the care without requiring immediate payment.

“I have advanced all the costs related to the intervention. The insurance had given its agreement for the reimbursement. The total amount was around 200,000 gourdes. »

But after the operation, the insurance did not pay.

“I waited. I have asked the company several times. Initially, they responded to me, they promised that the file would be processed. Then the responses became less frequent. And one day, nothing more. »

Despite repeated attempts, the refund was never made.

“I took steps for several years. I tried every possible recourse, until I no longer heard from the company,” regrets the specialist.

According to Dr Almazor, it was an insurance company reserved for employees of ONA.

AyiboPost attempted unsuccessfully to obtain contacts for this company before publication.

In a notice published in May 2014, the MEF published a list of eleven insurance companies eligible to carry out operations in Haiti. They are: International Assurance S.A. (INASSA), Alternative Insurance Company (2001), Assurances Léger S.A. (ALSA), SogeAssurance S.A., UniAssurance S.A., Compagnie d’Assurance d’Haïti S.A. (CAH), National Western Life Insurance Co (NWL), Nationale d’Assurance S.A. (NASSA), Haïti Sécurité Assurance S.A., Onyx Assurance S.A. and L’Atout Assurance S.A.

Next to this list is also OFATMA, an autonomous public institution under the supervision of the Ministry of Social Affairs.

OFATMA covers civil servants, certain employees of private companies, unionized employees in the informal sector as well as those in the formal sector.

However, it excludes the unemployed and is less inclusive of dependents of informal workers, says a World Bank report published in 2015.

In Haiti, access to health care is very limited, due to income disparities and high unemployment rates.

Insurance schemes are insufficiently developed and cover less than 5% of the population, in a context where the unemployment rate is around 30.1%, again according to the BRH report.

People who manage to benefit from insurance not only face irregularities in the system, but also a situation complicated by insecurity.

In Port-au-Prince, several hospitals had to close their doors or were vandalized following attacks by gangs, who now control 85% of the capital.

Several hospitals and health centers located at the bottom of the city were affected by waves of violence from thugs.

Read also: General Hospital: a vague reopening in an alarming health crisis

Only 37% of health facilities in Port-au-Prince are fully functional, despite access difficulties due to insecurity.

Policyholders have even fewer options.

Worldine François, beneficiary of INASSA insurance, faced this situation when she wanted to use her insurance policy a year ago.

“Among a list of hospitals and clinics covered by insurance and located at the bottom of the city, which I initially used to frequent, almost all are now closed,” she explains. I was forced to pay for the service myself in a center that was accessible to me. »

Cover | Front of the OFATMA building with people protesting in front. (Source:Unknown)

► AyiboPost is dedicated to providing accurate information. If you notice any mistake or error, please inform us at the following address : hey@ayibopost.com

Keep in touch with AyiboPost via:

► Our Channel Telegram : Click here

► Our Channel WhatsApp : Click here

► Our Community WhatsApp : Click here

Comments